The gleaming allure of gold has captivated humanity for ages. From the sunlit chambers of ancient pharaohs to the secure vaults of modern-day investors, its charm remains undiminished. As a symbol of wealth and power, gold’s legacy is as old as civilisation itself. Within this narrative, let’s explore gold bullion—its history, appeal, and why it’s still an investment of choice in today’s volatile financial world.

1. History’s Golden Thread

Gold, with its shimmering presence, has consistently played a pivotal role throughout the annals of human history. Ancient civilisations, such as the Egyptians and the Romans, used gold coins to showcase their wealth and exert their dominance. Their rulers, draped in golden robes and adorned with golden jewellery, became emblematic of the metal’s allure. As explorers set out to conquer new lands, tales of cities of gold, like El Dorado, fuelled their ambitions. These tales, though mythical, show the profound impact gold had on shaping the dreams and aspirations of entire generations. Moreover, the gold rushes of the 19th century, from California to Australia, marked significant migrations, where thousands risked everything for a shot at striking it rich, further emphasising the magnetic pull of gold.

2. Understanding its Appeal

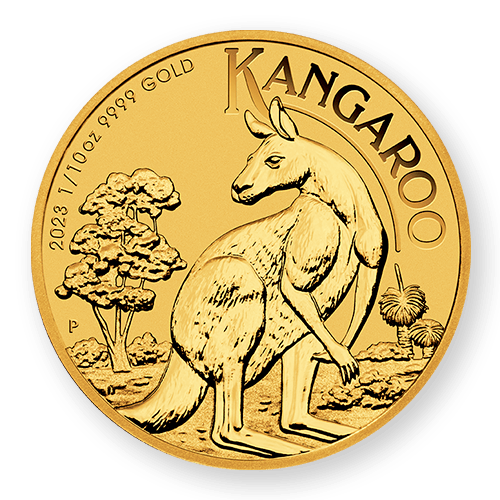

While gold is undoubtedly a thing of beauty, its allure extends beyond mere aesthetics. The intrinsic value of physical gold is multifaceted. It’s not merely about its weight or its purity. Gold’s permanence makes it stand out. In a world where paper currencies fluctuate due to inflation, political instability, and other economic variables, gold consistently retains its value. This stability, in many ways, makes it a shield against economic downturns. Additionally, its tangible nature strikes a chord with human psychology, offering a palpable sense of security in a way that intangible assets like stocks or bonds simply cannot.

3. Factors Influencing Gold’s Value

Gold’s value doesn’t exist in a vacuum. It’s a result of a confluence of various global factors. The balance of supply and demand, as with any commodity, plays a critical role. However, gold often sees surges in demand during geopolitical tensions as nations and individuals alike seek safe-haven assets. Inflation rates, interest rates, and central bank policies also hold sway over gold prices. As one continues to exhaust the Earth’s gold reserves, with mining becoming increasingly challenging and costly, a reduction in supply could propel its value even further in the coming decades.

4. Investing in Gold: A Time-Tested Strategy

The investment landscape has witnessed many trends, yet physical gold has stood the test of time as a favoured choice among astute investors. Its resilience to economic downturns, coupled with its reputation for maintaining—and often increasing—its value, make gold a reliable asset. It provides an anchor of stability, especially when other investments show volatility. Many financial advisors often tout the benefits of diversifying one’s portfolio, and gold serves as a counterbalance, mitigating risks associated with stocks, real estate, and other forms of investments.

5. Gold in Modern Times

As one progresses further into the digital age, gold’s role is undergoing a transformation. While the appeal of physically possessing gold remains, new avenues for investment have emerged. Digital gold investments and gold ETFs (Exchange Traded Funds) provide a contemporary twist to this ancient asset, allowing even the average individual to partake in gold’s financial benefits. These platforms offer the advantages traditionally associated with gold but remove the challenges tied to storage and ensuring physical security.

In Conclusion,

The financial terrains may shift, economies may waver, but the lustre of gold bullion remains undiminished. It stands as a testament to stability and trust, qualities that make it a preferred choice for investors spanning centuries. Whether for diversification, security, or its intrinsic appeal, gold remains a gleaming beacon in the investment universe. Embracing gold as part of one’s financial strategy isn’t just about historical precedent; it’s about understanding its unwavering position in a constantly evolving economic landscape. As global dynamics shift and markets face unpredictability, gold bullion offers a reassuring constancy, echoing the enduring value it has held through millennia.